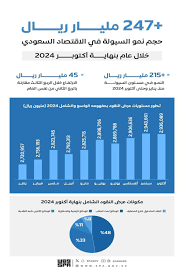

Liquidity levels, or “available money,” in the Saudi economy have grown by more than SAR247.647 billion year-on-year, reflecting an increase of 9.2% and reaching SAR2,936.089 billion by the end of October 2024, compared with SAR2,688.442 billion in the same period last year.

The growth is based on the broad money supply indicator (M3), according to data from the Saudi Central Bank’s (SAMA’s) monthly statistical bulletin for October 2024.

On a quarterly basis, liquidity levels grew by 1.5%, an increase of approximately SAR45 billion, reaching SAR2,943.661 billion by the end of Q3 2024, compared to SAR2,898.706 billion by the end of Q2 2024.

Since January 2024, liquidity has increased by 8%, adding over SAR215 billion from its starting level of SAR2,720.957 billion. The robust liquidity levels serve as a driver for economic and commercial activity, contributing to positive progress in the Kingdom’s economic development.

Demand Deposits, the largest contributor at 49%, totaled SAR1,425.489 billion by October 2024, while “Time and Savings Deposits,” the second-largest contributor, accounted for 33% of the total, with a value of SAR971.103 billion.

The third-largest contributor, the “Quasi-Monetary Deposits,” amounted to SAR312.506 billion, or 11% of the total.

Currency in circulation outside banks contributed to 8% of the total, with a value of SAR226.991 billion.

Quasi-monetary deposits refer to residents’ foreign currency deposits, deposits tied to letters of credit, outstanding transfers, and repurchase agreements (repos) executed by banks with the private sector.

These liquidity levels highlight the Saudi economy’s strong monetary foundation, supporting sustained growth and financial stability.